26+ tax disbursement mortgage

SOLD JUN 15 2022. 396000 Last Sold Price.

What Is Escrow Disbursement

Most of these costs.

. Comparisons Trusted by 55000000. Web Mortgage insurance makes it possible for you to buy a home with less than a 20 down payment by protecting the lender against the additional risk associated with low down. Web 1 day agoThe typical monthly principal and interest payment on a 30-year fixed-rate loan for a median-priced 350300 home in January 2022 with a 10 down payment was.

Web With 52 weeks in a year this amounts to 26 payments or 13 months of mortgage repayments during the year. Web Nearby homes similar to 6264 Shady Ln have recently sold between 396K to 396K at an average of 185 per square foot. A mortgage escrow account is an arrangement with your mortgage lender to ensure payment of your property tax bill.

Web As your lender shared with you during the financing process there are homeownership costs beyond your mortgage payment that require your attention. Estimate Your Monthly Payment Today. Ad More Veterans Than Ever are Buying with 0 Down.

Web When you take out a mortgage on a house the lender wants to ensure that enough money is being set aside for property taxes by having you pay so much each month into an. The property taxes listed on the 1098 form is what your lender paid to the taxing agency on your behalf. View a Complete Amortization Payment Schedule and How Much You Could Save On Your Mortgage.

Ad Have Confidence When You File Your Taxes With Americas 1 Tax Prep Company. Web A mortgage may be subject to an escrow or impound account for the collection and payment of taxes and insurance which could result in you receiving an escrow. This method is mainly for those who receive their paycheck.

Take the principal of your mortgage which is. A mortgage request will be completed and mailed within three. Ad 5 Best Home Loan Lenders Compared Reviewed.

Parents who owe support Parents who are due support Employers Missing Payment. Calculating your mortgage recording tax is relatively straightforward. Web January 30 2022 1159 AM.

Web How to Calculate Your Mortgage Recording Tax. That is the amount you claim. It costs the same no matter your credit score with only a slight increase in price for down payments less.

Looking For Conventional Home Loan. Ad How Much Interest Can You Save by Increasing Your Mortgage Payment. Web Yes the property tax disbursement from your mortgage servicers escrow account is the amount paid on your behalf for real estate taxes.

Web FHA mortgage insurance is required for all FHA loans. No Tax Knowledge Needed. Trusted VA Home Loan Lender of 300000 Military Homebuyers.

Web What is a Mortgage Escrow Account. Compare Lenders And Find Out Which One Suits You Best. TurboTax Makes It Easy To Get Your Taxes Done Right.

Web The term disbursement may be used to describe money paid into a business operating budget the delivery of a loan amount to a borrower or the payment. Salary and Employment Verification SEV-3 Last Updated on January 10 2020 business days of.

Escrow Accounts Explained Blog

Public Notices For Sep 18 2012

Image 001 Jpg

What Does An Escrow Payment On A Mortgage Mean

Back To Work Growing With Jobs In Europe And Central Asia By World Bank In Europe Central Asia Issuu

Kempegowda Layout Bda Sites Allotment Rules Procedure

Img 002 Jpg

Escrow Refund What Investors Should Know Mashvisor

Free 11 Sample Employee Declaration Forms In Pdf Excel Word

Why You Should Avoid Tax Refund Advance Loans Mybanktracker

4th Cir Reverses Dismissal Of Servicer S Respa Tax Escrow Disbursement Claim The Cfs Blog

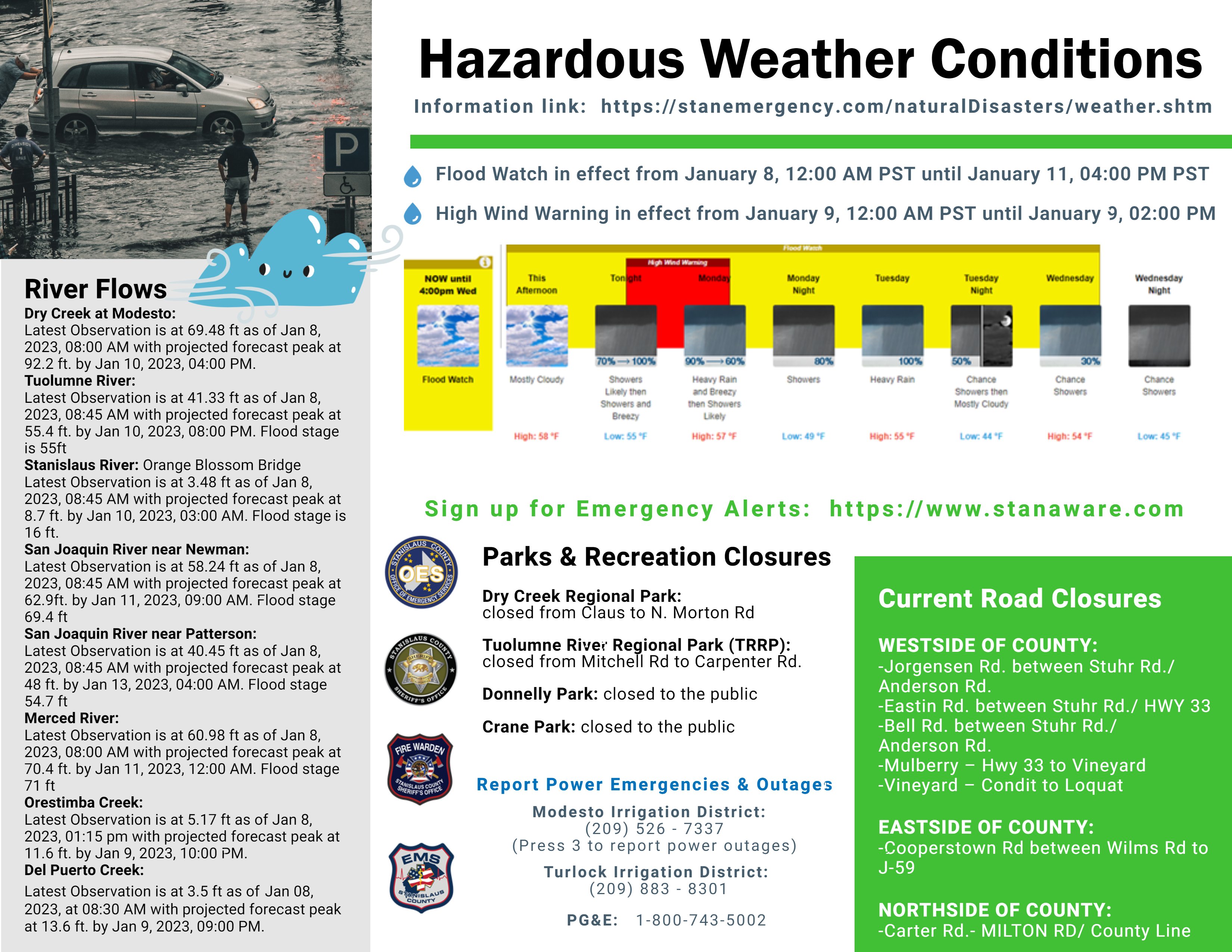

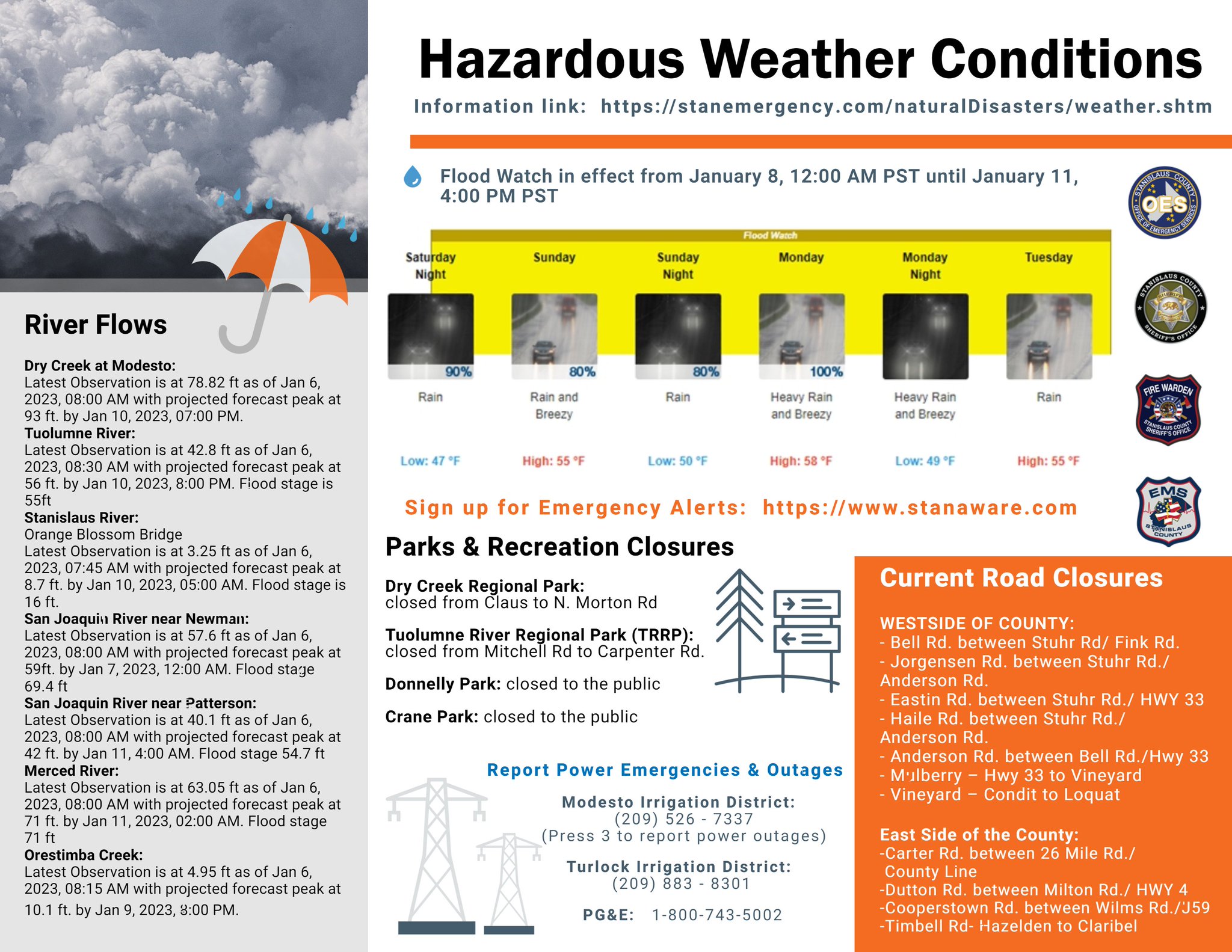

Stanislaus County Newsfeed

The Mortgage Interest Deduction Would Be Worth Much Less Under The Unified Framework Tax Policy Center

Stanislaus County Newsfeed

Why Do Some People Evade Tax Quora

Stanislaus County Newsfeed

Publication 936 2022 Home Mortgage Interest Deduction Internal Revenue Service